Reference:

Ichimoku Cloud

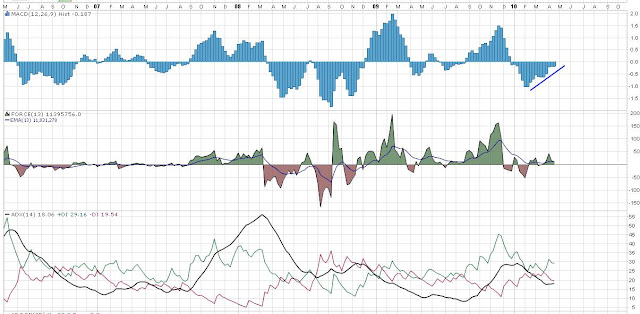

On the daily chart, Gold has cleared the cloud. Wait for Turning (blue) line to cross the Standard (red) line for an entry position.

On the weekly chart, the forecast calls for clear skies ahead.

The same goes for $XAU. Finally, let's take a look at the good old $USD:

On the daily chart, the $USD still looks bullish.

On the longer term weekly chart, the $USD is running into resistance, but is making a valiant effort to break through the cloud. US Treasury Bonds are forecasting that the $USD rally is not done yet.

It'll be interesting because of the inverse relationship between bonds and commodities. If bonds plummet then expect this to fuel another leg in commodities. Conversely, if bond prices go down, then yields go up, which is bullish for the $USD. Historically, bonds lead the overall market by 6 months. If bonds start going down, expect the markets to follow about 6 months later.

Notice how the commodity index, which is dominated by Oil, has quietly emerged from the cloud.